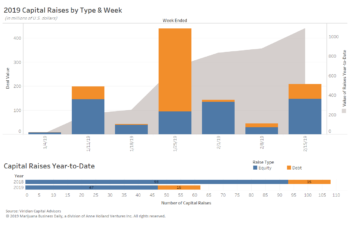

The data below, provided by Viridian Capital Advisors, is through the week ended Feb. 15.

Top takeaways from capital raises:

- California-based marijuana producer and distributor Flow Kana closed a $125 million raise – the largest private funding round for a cannabis company in the United States. “As the industry continues to commoditize, companies in the supply chain that can enhance effectiveness or efficiencies in operations – whether through better technologies or specialization and trade – can create value,” said Harrison Phillips, vice president at Viridian Capital Advisors. “Flow Kana is specializing in large-scale processing for small-scale farmers, providing ‘mom-and-pop’ operators access to equipment and services they would be hard-pressed to afford on their own.”

- Canadian licensed producers continue to lay claim to capital, including Quebec-based Hexo Corp. (HEXO on TSX and NYSE), which closed on a bank debt facility of 65 million Canadian dollars ($49.2 million) that includes a CA$50 million term loan and a CA$15 million revolving loan. The deal comes with an “uncommitted” option to increase the facility by up to CA$135 million.

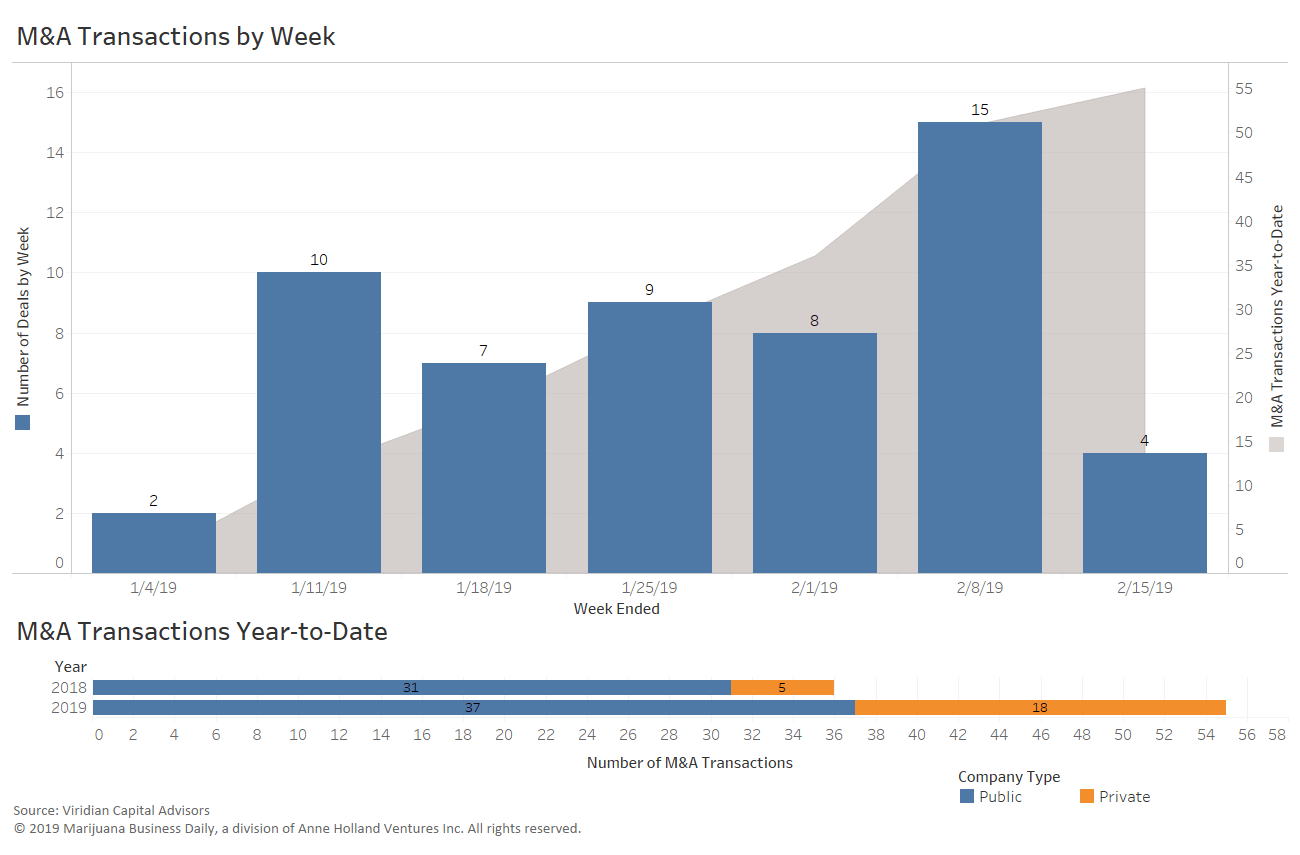

Top M&A takeaways:

U.S. medical market licensees remain top targets for acquisition, as illustrated by two key transactions:

“Newer markets are more likely to provide investors access to the first-movers, but they may need to wait some time for the market to develop and scale,” Phillips said.

“Conversely, entering into a more mature market likely provides less opportunity for organic growth but may present opportunity for consolidation.”

Viridian Capital Advisors is a financial and strategic advisory firm that provides investment banking, M&A, corporate development and investor relations services to emerging growth companies and qualified investors in the cannabis sector.

Source of article: https://mjbizdaily.com/weekly-deal-watch-new-cannabis-markets-ripe-investment/